Lawsuit alleges Mission Rock Residential misled tenants over future status of apartments

A class action lawsuit has been filed against the owner of a Tigard apartment complex that is planning to end its involvement in the federal Low Income Housing Tax Credit program.

The lawsuit was filed June 29 in Multnomah County Circuit Court and claims that Mission Rock Residential, the Denver-based firm that manages the Woodspring Apartments, misled tenants into believing the complex would remain, as it had been for many years, exclusively for residents age 55 or older with rents kept below market rate. The suit was filed on behalf of a tenant named Cheyenne, who did not list a last name, and other senior tenants.

Portland attorney Michael Fuller is the lead counsel for the plaintiff. He said the suit alleges that Mission Rock Residential violated an Oregon statute that controls what a company can and cannot do when advertising real estate.

“One of the things you can’t do is misrepresent the qualities and characteristics of what they are selling,” Fuller said. “You can’t affirmatively lie, and you also cannot omit information that would be important in the decision making process.”

Cheyenne signed a lease in June of 2020 believing that Woodspring would remain an age- and rate-restricted property. Just six months later, however, Mission Rock and its investment partner, Hamilton Zanze out of San Francisco, announced that the property would be moving to market rate status and would be renting to tenants of all ages at the end of a three year grace period provided under Oregon law.

“We are alleging that that law has been violated with respect to seniors who moved in over at least the last five years,” Fuller said.

“Defendant misled low-income seniors into thinking that Woodspring Apartments was a place they could move to retire on a fixed income,” the opening of the lawsuit filing reads. “In reality, Woodspring Apartments was owned by a $4.7 billion out-of-state investment corporation that bought the property with the intent to raise rents and force out low-income seniors, as soon as the corporation’s 30-year agreement with the government to keep the property affordable expired.”

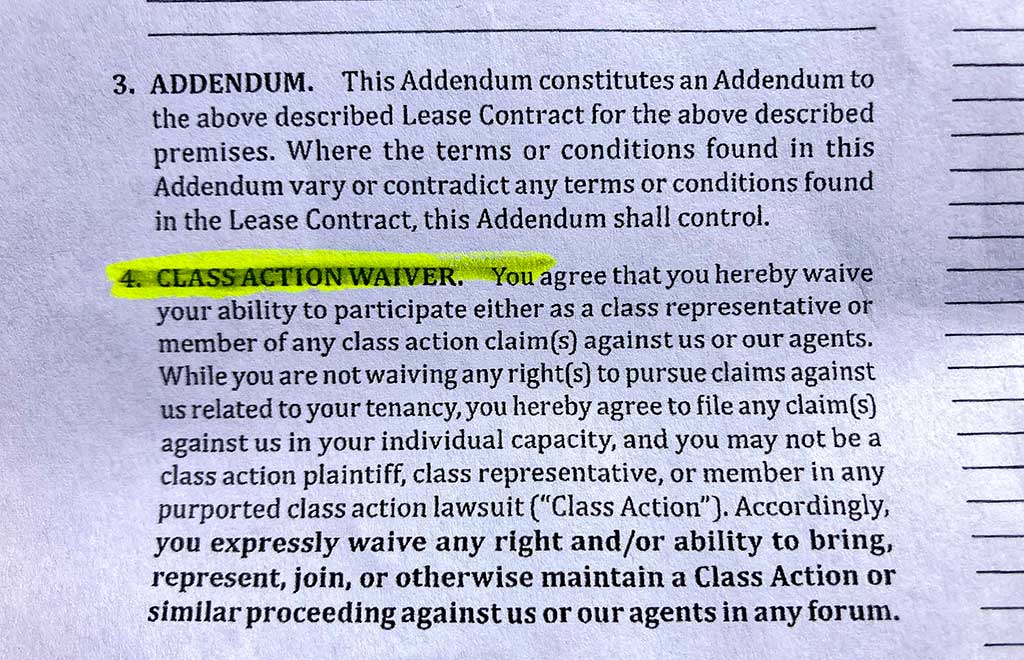

More recently, new leases being offered to tenants even include a clause prohibiting tenants from participating in class action or other legal action against the owner.

Mission Rock spokesperson Jill Eiland said the company would not be offering comment about the situation.

“Unfortunately, given that there is a pending legal case, the company is unable to offer a statement,” Eiland said in an email.

The Woodspring Apartments were built in 1991 off Durham Road in Tigard. Its 172 units were rented as affordable housing because the property was built using the federal Section 42 Low Income Housing Tax Credit program offered by the Internal Revenue Service. This allows tenants making 60 percent or less of the regional average median income to pay rents that are well below prevailing market rates.

This program has been a lifesaver for tenants like Karen Keenan. Keenan moved to Wood springs five years ago after watching her rent at a Tualatin complex increase from $799 a month in 2009 to $1,400 a month by 2016.

Now, residents like Keenan are facing another potential relocation after the current owners of Woodspring elected to leave the Section 42 program.

“We’re all in the same boat,” Keenan said. “Everybody has a different story. It’s a problem that’s not just Woodspring, it’s nationwide.”

Section 42 tax credits typically carry a 30-year commitment to providing below-market rents. After that period, the owner may choose to continue in the program or they may withdraw and offer the units at prevailing market rates.

Six years ago, San Francisco-based real estate investment firm Hamilton Zanze acquired the Woodspring complex. They announced on Dec. 31, 2020, that they intend to withdraw from the Low Income Housing Tax Credit program in favor of renting the apartments at full market value and without any age restrictions.

Fuller said the class action suit is intended to provide either compensation for current tenants who were misled about the status of the apartments or a reversal of the owner’s intention to remove the property from the Section 42 program.

“The goal is to allow seniors to stay in these apartments and to keep these apartments seniors only and to keep them affordable for the rest of their natural lives, which was what they were told would be allowed to happen,” he said.