Owning a home, a long-time cornerstone to many people’s long-term financial goals, has grown elusive to some young homebuyers in recent years. In addition to the coronavirus pandemic, economic factors like student debt, wages not keeping up with inflation, and a competitive housing market have made it difficult for millennial and Generation Z (Gen Z) homebuyers to get their foot in the door.

However, there are still plenty of opportunities for hopeful buyers to achieve their dream of owning a home.

Economic Challenges Facing Young Homebuyers

The average federal student loan debt per person sits at just under $38,000.

To make matters worse, wages have failed to keep up with inflation in recent years, making it difficult to save up for a down payment. These economic factors make it challenging for younger generations to qualify for a mortgage. As a result, many young homebuyers are not considering home ownership.

The Impact of Those Economic Challenges

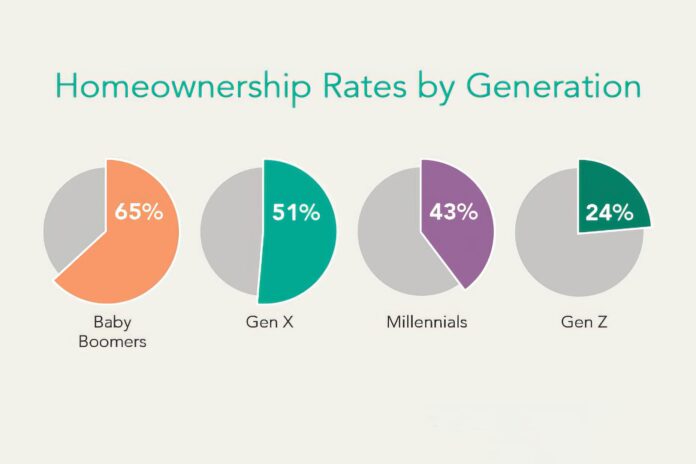

Currently, the homeownership rate for millennials sits at around 43 percent, compared to 51 percent for Gen X and 65 percent for baby boomers of the same age. The homeownership rate for Gen Z sits even lower at around 24 percent.

Millennials are typically considered to be those born between 1981 and 1996; Gen Z refers to those born between 1997 and 2012. Gen X includes people born between 1965 and 1980; baby boomers were born between 1946 and 1964.

Without access to homeownership, these generations may face greater financial insecurity and an inability to build long-term wealth. This can lead to decreased economic mobility and a widening wealth gap between generations.

How Young Homebuyers are Adapting and How PacRes Can Help

One approach is to explore an alternative financing option, like an FHA loan or a down payment assistance program. These products are designed to help hopeful homebuyers overcome the hurdle of a large down payment.

Others search for a home in less expensive areas or areas with a lower cost of living, or they choose to purchase fixer-upper properties that require renovations or repairs. Fixer-upper properties can be a more affordable option than purchasing a move-in ready home.

Still, others may explore opportunities to invest in real estate through rental properties or “house hacking,” where they purchase a property with the intention of renting out a portion of it to generate income. PacRes Mortgage offers unique loan options for investors and house hackers alike, from conventional to jumbo.

Finally, some house hunters have embraced more creative options, like living in a tiny home or a co-living space. Living in a tiny home, which is typically under 500 square feet, has grown popular as an affordable and environmentally-friendly housing option. Additionally, tiny homes can be placed on smaller plots of land, which can be less expensive than larger parcels.

Co-living spaces, on the other hand, offer residents the opportunity to share communal living areas and expenses while also enjoying their own private living spaces. Plus, co-living spaces often come equipped with amenities that might be costly for individuals to access on their own, such as a gym or a communal kitchen.

PacRes Mortgage understands the unique needs of today’s young homebuyers and offers a wide range of resources and loan products to support your unique lifestyle and long-term financial goals. Whether you’re exploring alternative financing options, looking for a fixer-upper property, or are interested in investing in real estate, your neighborhood Mortgage Advisor is here to help you move through every step of the mortgage process with confidence.

How Homeownership Builds Long-Term Wealth

Homeownership may feel like a big financial hurdle, but it can pay off significantly in the long run!

One of the biggest advantages of owning a home is that it can build long-term wealth; while this may require a significant upfront investment, it can pay off down the road through equity buildup, appreciation in home value, and tax benefits.

As the value of the property appreciates, homeowners can realize greater profits if they decide to sell their home or borrow against the increased equity.

Ready to Secure a Strong Financial Future?

Let’s work together to ensure your long-term wealth and financial stability. If you have questions or want to take the next steps, give Tim a call today.

Ready to Take a Confident Next Step? Give Tim a call Today!